INTERNAL REVENUE CODE SECTION 280E

What is Section 280E?

Section 280E of the Internal Revenue Code forbids businesses from deducting otherwise ordinary business expenses from gross income associated with the “trafficking” of Schedule I or II substances, as defined by the Controlled Substances Act. The IRS has subsequently applied Section 280E to state-legal cannabis businesses, since cannabis is still a Schedule I substance.A throwback from the Reagan Administration, Section 280E originated from a 1981 court case in which a convicted cocaine trafficker asserted his right under federal tax law to deduct ordinary business expenses. In 1982, Congress created 280E to prevent other drug dealers from following suit. It states that no deductions should be allowed on any amount “in carrying on any trade or business if such trade or business consists of trafficking in controlled substances.”With 23 states and the District of Columbia now allowing some form of legal marijuana, 280E is applied to state-regulated cannabis businesses more often than it is to the types of illegal drug dealers that the provision was intended to penalize.

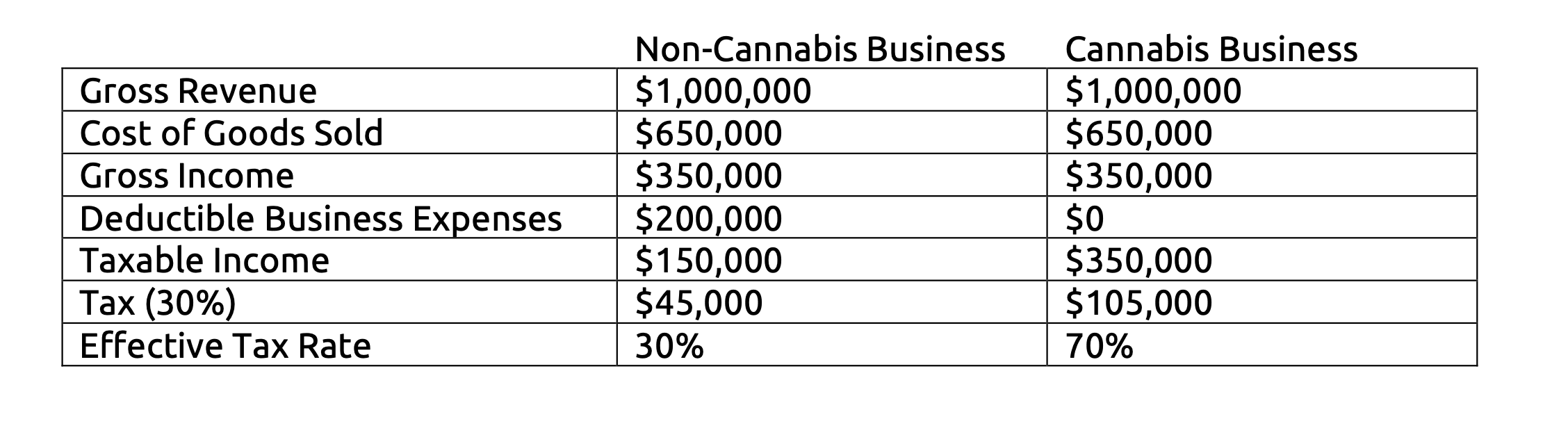

How does Section 280E hurt state-legal cannabis businesses?

“I’m taxed on nearly double the amount that my business actually makes.”- John Davis, Northwest PatientResource Center!

What types of business expenses are scrutinized under 280E?

- Employee salaries

- Utility costs such as electricity, internet and telephone service

- Health insurance premiums

- Marketing and advertising costs

- Repairs and maintenance

- Rental fees for facilities

- Routine repair and maintenance

- Payments to contractors