Three trends affecting the U.S. cannabis industry in 2026

As the U.S. cannabis industry moves into a new year, shifting market dynamics are already reshaping how businesses operate and compete. From licensing activity to pricing behavior, emerging patterns from 2025 offer a clearer picture of where the regulated market is stabilizing—and where pressures are still building.

As the U.S. cannabis industry enters 2026, shifting market dynamics are reshaping how businesses operate and compete.

From licensing activity to pricing behavior, patterns that emerged in 2025 offer a clearer picture of where the regulated market is stabilizing – and where pressures are still building.

280E tax relief will greatly expand retailer profit, reinvestment:

Notorious Internal Revenue Service Code Section 280E continues to strain plant-touching cannabis businesses, often erasing retailers’ profitability even in otherwise strong markets. However, President Donald Trump’s Dec. 18 executive order rescheduling marijuana promises long-awaited tax relief for cannabis businesses.

In many states, the 280E tax burden exceeds a retailer’s entire net profit, effectively wiping it out. In several markets, the median cannabis store is already operating at a net loss before accounting for expansion, reinvestment or other growth efforts.

The rule also locks up significant cash at the store level.

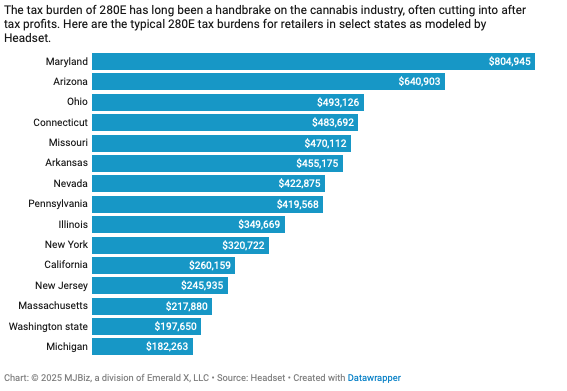

According to modeling from Seattle-based Headset, 280E means between $400,000 and more than $800,000 in extra tax liability per store each year. That limits operators’ ability to invest, hire or weather downturns.

Typical 280E tax burden for retailers:

280E means operators can’t deduct major expenses such as payroll, rent and regulatory compliance as business expenses on their federal tax returns. That structure hits hardest when margins are thin. The impact is most severe in competitive, mature markets where pricing pressure is highest. In those states, retailers face the largest mismatch between profits and taxes, even as consumer demand remains strong.

Licensing trends differ by category:

The number of active cannabis business licenses in the United States declined to 37,555 in the most recent quarter. That’s down about 1% from the previous quarter, extending a downturn that has persisted since late 2022.

Over the past two years, the total number of active licenses nationwide has fallen 13%, underscoring a prolonged contraction across the regulated cannabis industry.

Marijuana growers accounted for most of the losses during that period. Cultivation licenses dropped 24%, or just over 5,000 permits, since the third quarter of 2023.

By comparison, the number of retail licenses have remained mostly flat, declining by 330.

The decline in cultivation licenses may be a positive development, as some industry analysts believe the U.S. cannabis market is oversaturated.

At the end of the third quarter, there were about 16,000 active cultivation licenses in the United States, compared with roughly 11,600 retail or dispensary licenses.

Some licenses can support more than one location, but the imbalance remains notable.

By contrast, Canada’s market is far more weighted toward retail. The country has a roughly 4-to-1 ratio of retail licenses to cultivation licenses, with more than 4,000 retail licenses and just under a thousand (910) cultivation licenses.